Expert Financial Planning Advice

Our goal

To support you to “Live your best life without worry or regret”.

Our goal

- To support you to “Live your best life without worry or regret”.

Our values

- Building partnerships with you based on trust;

- Education before advice: empowering you to make informed decisions based on facts;

- Delivering a professional financial plan, via our robust, regulated financial planning

advice service; - Transparent value for money, fixed fee service;

- Treating you as we would want to be treated ourselves.

Our “Why”, we do what we do because we;

- care about you and the people you care about.

- believe that clients should pay fixed fees only when they need to.

- want to provide independent, unbiased advice.

- believe in transparent value for money, fixed fee service;

- want our clients to be treated as we would want to be treated ourselves.

Our Services

New clients

All new clients to Expert Pensions Advice are “onboarded” to our system which allows us to collaborate with you to build the right plan, enabling you to live your best life.

Initial Meeting

The initial meeting is at our expense.

This gives us both the opportunity to see if we can work together.

Once you engage our service you move into our Plan, Do, Review service.

Step 1: Plan

This is where we find out more about you and what you want to achieve – what are your objectives: what is your plan? What is your best life?

How can we help you live your best life?

We’ll analyse your current position and help you define your financial and lifestyle objectives – do you know what your best life looks like?

We will then present our report to you and make our recommendations for how you can achieve your financial best life. It may be as simple as making a few changes. Sometimes it may involve compromises or decisions that you have to make about your priorities – and we set out the options to help you make those informed decisions. Those options will be independent, unbiased and focused on your best interests.

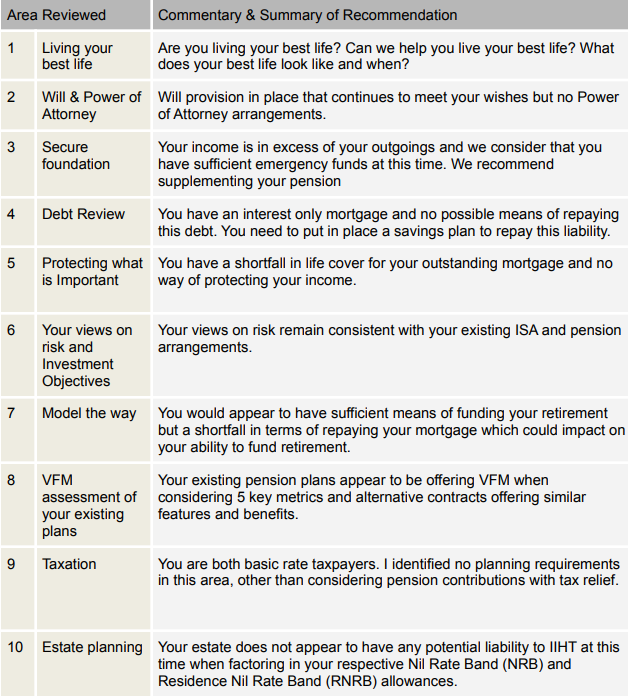

Part of the plan will include a full Financial Health Check.

Your Financial Health Check

Step 2: Do

We will make our recommendations and present options to you in our financial planning report which forms part of your personalised financial plan.

If you decide to take our recommendations forward, then making it happen for you will require more work and more time.

We can then help you action your plan by implementing any changes we recommend on your behalf.

Step 3: Review

There is no obligation to engage our ongoing review service but the value of engaging an adviser on an ongoing basis should be considered.

Here is a quote from our regulator, the Financial Conduct Authority (FCA) explains it well:

‘’Consumers can only pursue their financial objectives where firms support them in using the products and services they have bought.

A product or service that a customer cannot properly use and enjoy is unlikely to offer fair value.’’

Our Fees

Fixed, transparent fees are at the core of what we do.

You should only pay for the services and advice that are right for you.

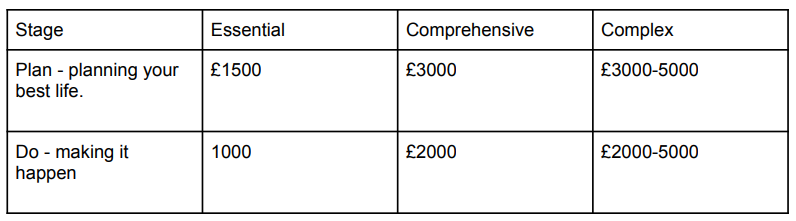

Plan & Do

Review

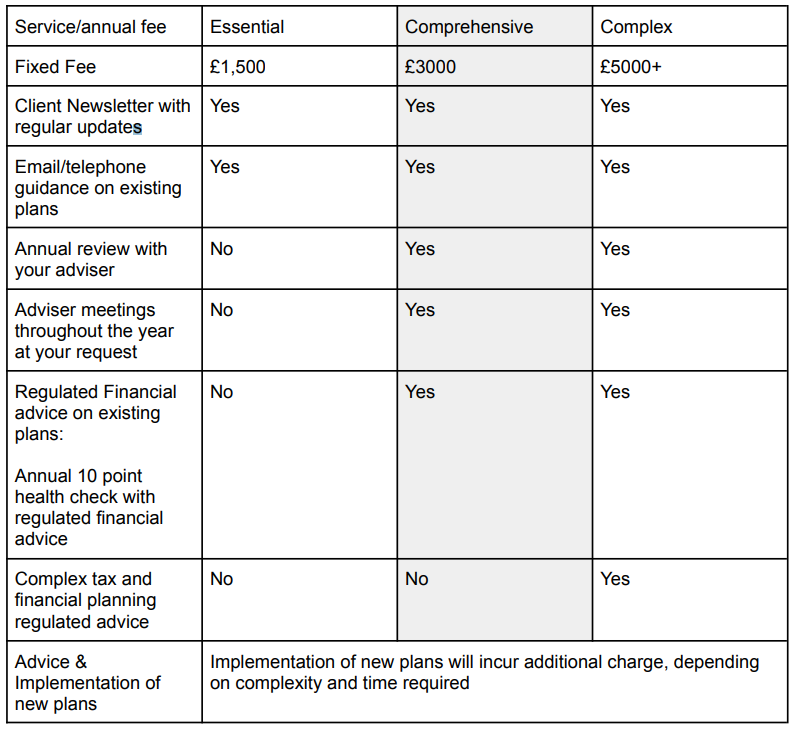

Should you decide to engage our services to build a long-term working relationship, our ongoing service provides you with;

- Regular meetings

We believe that financial planning is a long-term (ad)venture. Once we have set up your financial plan, life will naturally continue to happen and changes are inevitable. Financial matters can be complex and you may not always be aware of the impact particular changes could have on your financial position. The frequency of review meetings can be varied to reflect the level of service you require from us; - Updates and communication

We form long-lasting relationships with our clients, based on open, ongoing

communication. This helps us understand you and what you need from us and enables us to support you with any change in your circumstances. Some clients only require a ‘light touch’ service without regular support throughout the year.

An annual meeting offers reassurance and reminds clients what they need to do to stay on track. It allows us to adjust your plans where circumstances or your priorities have changed. Other clients benefit from more frequent support and help with their financial decisions. We will discuss this with you and recommend an ongoing service that suits your needs during the planning process; - Ongoing support

Our clients often contact us with general finance queries and we are only too happy to help where we can. Clients value having someone they know they can trust and go to for clear and straightforward advice; - Monitoring

It’s important to monitor how changes in your life and finances could affect your ability to meet your goals Regular review help you stay on track with your plans, adjusting them when needed;# - Guidance

If you are seeking support with something that is outside our area of expertise, we will point you in the right direction. We have a wide and well-established network of professional connections who we can recommend to you;

Ongoing Fixed Fees

Examples of fees

Here are a range of examples to help you understand what your fee could be:

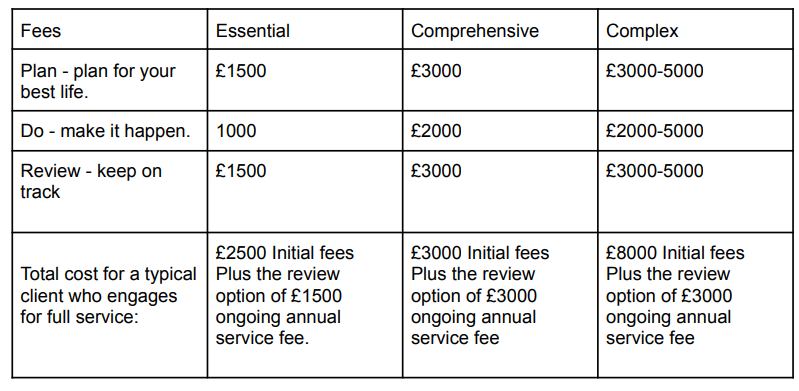

Example 1 – A client who needs help understanding where they are financially, involving an overview of your current arrangements and advice on any changes we feel you need to consider to help you achieve your goals, with less complex implementation. The analysis and research requirements are less detailed. It will usually involve setting up a new product from deposit savings or changing the investment content within an existing pension or investment to suit the plans or goals without changing the provider.

The fee will be £1500 for planning (the initial financial planning phase) + £1000 (for the implementation or doing phase) = £2500 No ongoing support needed.

Example 2 – A client who requires detailed analysis of their current financial arrangements such as existing and various pensions and investments. They may be seeking specific planning advice, for example, on Inheritance Tax planning or pension income withdrawal. It could be clients who are retiring imminently and need help planning for the future.

The total fee will be £3000 for planning (the initial financial planning phase) + £2000 (for the implementation or doing phase) = £5000

Ongoing support was only required at the essential level. No further regulated advice was anticipated and the ongoing fee was £1500pa.

Example 3– Where we are implementing a complex pension transfer, setting up multiple trusts or intricate tax planning strategies alongside their investment recommendations and where we are advising of different planning needs that require significant changes such as: pension planning with detailed tax calculations and investment advice.

The total fee will be £4000 for planning (the initial financial planning phase) + £3000 (for the implementation or doing phase) = £7000

Ongoing ‘’keeping you on track’’ comprehensive support was required and the ongoing fee was £3000pa.

Example 4 – A client who needs help understanding where they are financially, involving an overview of your current arrangements and advice on any changes we feel you need to consider to help you achieve your goals, with less complex implementation. The analysis and research requirements are less detailed. It will usually involve setting up a new product from deposit savings or changing the investment content within an existing pension or investment to suit the plans or goals without changing the provider, but who now has an inheritance of monies

and assets that require more complex ongoing support:

The fee will be £1500 for planning (the initial financial planning phase) + £1000 (for the implementation or doing phase) = £2500

Ongoing ‘’keeping you on track’’ comprehensive support was required and the ongoing fee was £3000pa.

Example 5 – A client who requires detailed analysis of their current financial arrangements such as existing and various pensions and investments. They may be seeking specific planning advice, for example, on Inheritance Tax planning or pension income withdrawal. It could be clients who are retiring imminently and need help planning for the future.

The total fee will be £3000 for planning (the initial financial planning phase) + £2000 (for the implementation or doing phase) = £5000

Ongoing ‘’keeping you on track’’ support was only required at the essential level. No further regulated advice was anticipated and the ongoing fee was £1500pa.

All fees are fixed and agreed prior to the commencement of advice.

Every plan starts with a 10 point health check to kickstart your financial planning – you can se an example below.

It is from that we will assess the complexity of your situation.

Typical cost for engaging our full service

Get in touch?

We work exclusively online. All our meetings are conducted on online, recorded and saved for your protection and ours.

If you have any questions, please get in touch with a member of our team.