UK to Australia transfers

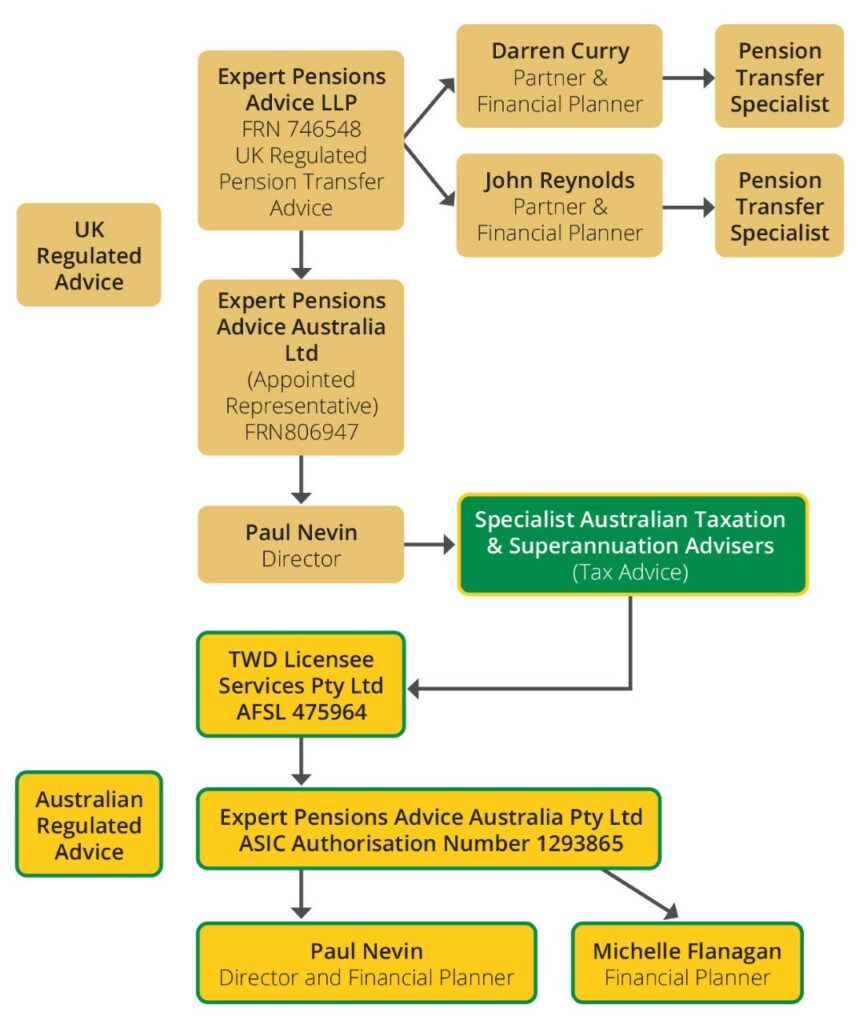

The ‘Expert’ Companies are a global operation with offices in the UK and Australia. We are a specialist provider of cross-border financial solutions. Our unique ability to integrate an unparalleled range of financial services, with licenced UK and Australian advisers, allows us to meet our clients’ varied needs both locally and across the globe.

The ‘Expert’ Group of Companies consists of:-

- Expert Pensions Advice Australia Ltd. (UK)

- Expert Pensions Advice Australia Pty Ltd. (Australia)

Expert Pensions Advice Australia, in UK, specialises in Pension Transfer advice to Australia. We can advise on Defined Benefit or Final Salary pensions as well as Defined Contribution or Money Purchase Pensions.

We work with a renowned firm of Australian Taxation Specialists to assist individuals to transfer their pension accounts from a UK scheme to Australia.

Expert Pensions Advice Australia, based in Australia, provides a broad range of in-house financial services such as superannuation, risk management strategies, asset protection, Australian investments, and retirement planning.

Where a member has benefits in a UK pension account, in order to transfer that benefit to Australia, several things must be in place:

- The members of the fund must be 55 years of age or older.

- If the money is to be rolled over, the receiving fund needs to be a Registered Overseas Pension Scheme (ROPS).

- Any rollover to a fund in Australia needs to take into consideration

a. The taxation implications in Australia.

b. The contribution limits in Australia.

c. The taxation implications in the UK (this is dependent on 2. above, and whether any amount rolled over is refunded back to the member in Australia). - If the money is to be taken a lump-sum (from a UK perspective), the Australian and UK taxation implications need to be considered.

The benefit of rolling over to an Australian fund is two-fold:

1. The growth that the pension assets have experienced since the member became an Australian resident is taxed at 15% (rather than the individual’s marginal tax rate, which could be up to 47%).

2. This growth component does not count towards the concessional or non-concessional contribution limit.

However, the balance in the UK fund that the individual had at the time that they became an Australian resident is assessed towards the non-concessional cap, and therefore the value of this amount needs to be taken into consideration. If it is greater than the cap (which could be between $0 and $330,000, depending on the member’s circumstances, including their contribution history and their total superannuation balance), then the excess may need to be refunded, or excess non-concessional contributions tax paid.

There are strategies available, taking into consideration the UK and Australian superannuation / pension provisions, as well as the multi-jurisdictional taxation provisions to:

a. Transfer an individual’s entire UK pension scheme accounts to Australia within a 12-month timeframe, regardless of the value.

b. Transfer an individual’s UK pension accounts in excess of their lifetime allowance to Australia without any further adverse implications, aside from the incurrence of the lifetime allowance charge.

c. Consider a strategy as above, even where the implementation may have been commenced and the funds are in separate accounts in the UK ready for a multiple step / year transfer to Australia.

d. Utilise a ROPS in Australia that is not an SMSF – there is a publicly available scheme that is on the ROPS registry.

In the implementation of any strategies above, there are some timing considerations, particularly where the individual has benefits within a defined benefit fund in the UK. In those situations, they will require advice from a UK Financial Adviser who is accredited with the UK Financial Conduct Authority. Such advisers can also be of assistance in the implementation from the UK side.

Despite some timing issues, as mentioned above, there is still the ability to transfer the schemes in full to Australia within 12 months.

There are many factors to consider with the transfer of such benefits, particularly the tax implications, and which option might be the best one for you. For some people, keeping the money in the UK might be preferred, receiving a regular income stream for life. However, it if worthwhile considering your options, and the ability to transfer your benefits to Australia within a reasonable timeframe, managing any of the taxation liabilities in the most appropriate manner.

If you would like to speak to us about your UK pension and the potential to bring the funds into Australia, please contact me on [email protected]

Downloads

Read more about our team

Get in touch?

We work exclusively online. All our meetings are conducted on online, recorded and saved for your protection and ours.

If you have any questions, please get in touch with a member of our team.